Written by Sarah Munger for FBLE

This is the final installment of a three-part series devoted to conservation compliance under the farm bill. The first post explained what “conservation compliance” is and why it matters, and the second post highlighted how lack of enforcement undercuts effective protection for soil and water resources. Rounding out the series, this post explains why maintaining the link (or “coupling”) between crop insurance eligibility and conservation compliance is critical for our food security.

Under the current farm bill, if farmers fail to adhere to conservation compliance provisions, they risk their eligibility for crop insurance premium subsidies. While other farm bill benefits, like disaster assistance payments, are also at stake, crop insurance is noted as the “most important component of the farm safety net.”

While other farm bill benefits, like disaster assistance payments, are also at stake, crop insurance is noted as the “most important component of the farm safety net.”

The Rise of Crop Insurance

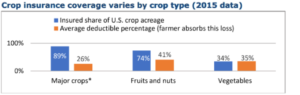

Since its humble beginnings in the aftermath of the Dust Bowl, crop insurance has grown to cover more than 297 million acres and over 130 commodities—from grapefruit to wheat. As of 2015, crop insurance covered almost 90% of acresdedicated to major commodities (e.g. corn, wheat, and soy). Given the ever increasing breath of the federal crop insurance program, crop insurance benefits provide a vital incentive for complying with farm bill provisions that aim to protect soil and water quality.

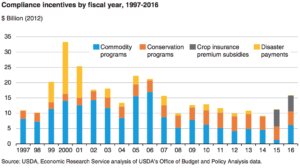

In the 1996 Farm Bill, Congress “de-coupled” crop insurance eligibility from the conservation compliance requirements. Consequently, between 1996 and 2014, the risk of losing direct payments provided the main incentive for farmers to abide by conservation compliance. The USDA Economic Research Service (ERS) reasons that, at the time, linking conservation compliance to direct payments made more sense because the crop insurance program was small with relatively low participation.

Source: USDA/RMA, The Risk Management Safety Net, September 2017; deductible calculated by FCA-ORP using RMA data. *Includes corn, soybeans, wheat, cotton, sorghum, barley, rice, peanuts, potatoes, and tobacco.

Source: USDA/RMA, The Risk Management Safety Net, September 2017; deductible calculated by FCA-ORP using RMA data. *Includes corn, soybeans, wheat, cotton, sorghum, barley, rice, peanuts, potatoes, and tobacco.

This calculus had changed when negotiations over what became the 2014 Farm Bill began. Increasing subsidy rates and participation in crop insurance motivated re-coupling crop insurance and conservation compliance. In addition, the direct payments that kept many farmers in compliance were facing increasing political unpopularity, and environmental advocates who saw the writing on the wall fought to tie conservation compliance back to crop insurance.

Conservation Compliance Is Risk Management

Tying crop insurance benefits to conservation compliance makes sense because federal crop insurance is a tool to manage riskfor losses in yield and revenue. Yet, poor soil management practices and destruction of wetlands impact long term sustainability and resilience of agricultural systems. Failing to adhere to conservation compliance provisions creates inherent risks that affect yield and revenue.

Farmers should not be rewarded with taxpayer dollars for these risky practices, especially when taxpayers subsidize nearly 65% of total premiums. In 2016 alone, this amounted to over $59 million in federal expenses. Those subsidies should not benefit those who violate conservation compliance provisions; thus, linking crop insurance and conservation compliance underscores the importance for a strong enforcement program, discussed in prior posts.

Absent a link to crop insurance, compliance rates would decline and further undermine the bargain between farmers and the public. The public provides a financial safety net for farmers, and in return farmers provide a food safety net to the public. The resilience of our nation’s food system hinges on soil and water quality, making conservation compliance a linchpin of this bargain. It is critical that crop insurance remain coupled with conservation compliance in the next farm bill.

Source: USDA Economic Research Service

Source: USDA Economic Research Service

Health Law & Policy, Commentary

Gearing Up for 2025: Advocates Share Challenges and Opportunities – Health Care in Motion

December 18, 2024